This blog is part of a larger series about digital health in Europe. Check out why and how we’re systematically mapping out the Digital Health ecosystem in Europe and our full analysis of 600+ digital health startups founded in Europe in the last decade. TLDR: as one of the most active investors in early-stage Digital Health in Europe, we’re surprised how little data there is on this fast-growing vertical. We want to change that.

An overview of Digital Health in Europe would be incomplete without mentioning one of the key events in a startup’s life — for the ~1% (yes, one percent) that get as far as this point: the exit.

As part of our deep dive into the European Digital Health ecosystem, we analyzed all the exits in this space to date. The key learnings:

- Over the last decade, there have been only 22 publicly known acquisitions in Digital Health in Europe.

- 13 exits took place in the last 12 months alone.

- No IPOs yet, all exits to date have been M&A.

Nothing happened for 8 years, then a lot happened in 2 years

Here’s a visualization of why we believe this is only the beginning of Digital Health’s time in Europe.

Three high-level observations about these transactions:

- This is an extremely low number. In the US, more than 52 Digital Health exits happened in the first half of 2020 alone. That’s 2.5 times Europe’s exit activity from the entire last decade.

- Almost all transactions are private M&A with confidential terms, which comes as little surprise but makes it hard to benchmark exit valuations.

- All startups that exited (except Aurora Health) were founded from 2011–2015.

- European digital health founders have been eager to exit quickly, but for fairly small returns. We expect this to change.

Exit targets: mental health, consumer health and generalist telemedicine

Taking a closer look at the types of Digital Health companies acquired, the chart below shows that consumer startups with a mental health focus and on-demand telemedicine have been the most popular exit targets, representing 50% of all exits.

Diving deeper into which startups feature in the 2 main categories, we see:

- The most popular acquisition targets have been consumer-facing mental health apps like 7Mind (mindfulness), 5th Corner Inc (behavioral learning programs), Aurora Health (depression screening), Shim (chatbot for wellbeing) and Soma Analytics (workplace mental resilience programs).

- On-demand telemedicine providers like Teleclinic in Germany and Mes Docteurs in France rank second. This category could also include players like (back then insolvent) German medical tourism provider Caremondo and Doctolib-like Keldoc from France, which offer appointment booking for offline and telemedical consultations.

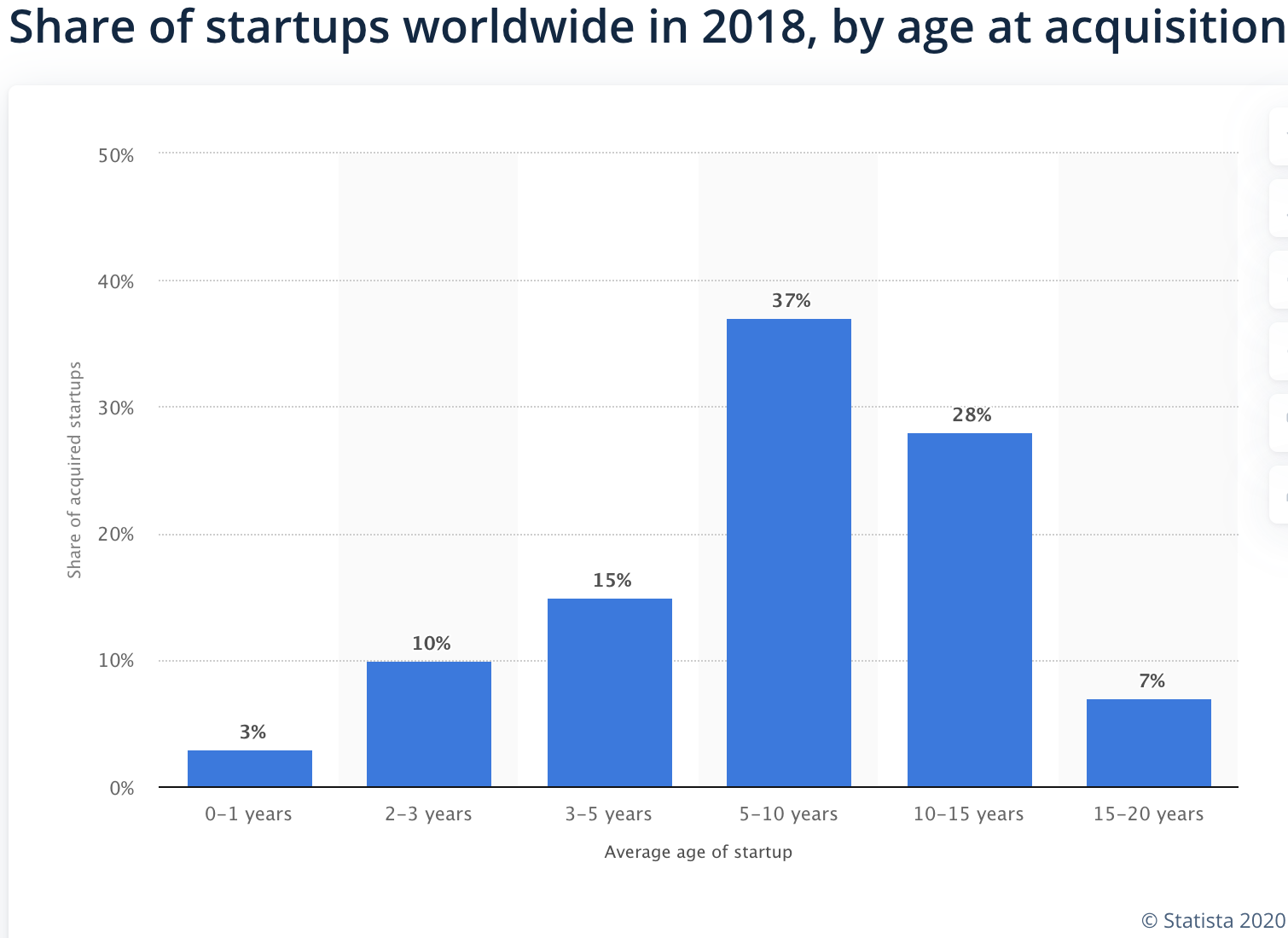

Time to exit: 5 years

The age at which Digital Health startups exit is evenly distributed. Both the average and median time to exit is five years. For context, a quick comparison below shows that Digital Health companies on a shorter path to exit relative to other startups.

Based on our experience and insights, we think this is because digital health founders generally exit too quickly, often at the first opportunity that presents itself. VCs may frown at this, but Daniel Keiper-Knorr has a case when he argues that even smaller exits can be life-changing and huge learning experiences for founders. Given how few breakout digital health cases we’ve seen in Europe to date, we also understand that founders have doubts about longer-term growth options.

Funding until exit: surprisingly low

Notably, European digital health companies don’t always raise a lot of money before they exit, and total funding per startup is less evenly distributed with two points of note:

- As we see, only Touch Surgery and Biovotion raised significant funds above the €10M threshold prior to exit, which accounts for 44% of the total funds raised by exited startups.

- Average funding (where we can access this data) is at €6m, while the median funding is €1.7m, which is broadly in line with the overall European data we analyzed in our deep dive into 600+ European Digital Health startups.

All together, Digital Health founders in Europe seem eager to exit quickly, but for fairly small returns.

Acquirers

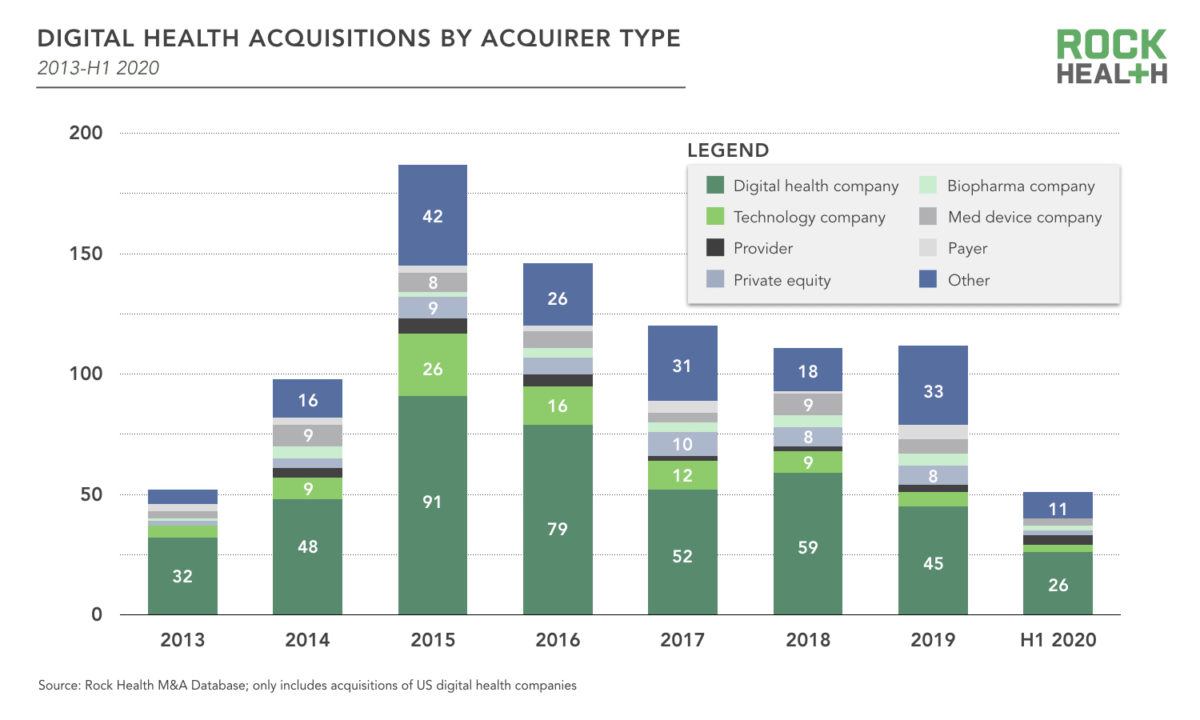

So, who is buying Digital Health startups? First, take a quick look at Rock Health’s summary of the US exit market.

In Europe, by contrast, most acquirers fall into the following four categories.

Digital Health Players

- Both in the US and Europe, Digital Health companies are the biggest acquirers of Digital Health companies. This mirrors general trends in the software industry and shows the importance of Digital Health unicorns to the ecosystem; they’re major sources of capital and M&A activity. As more companies mature in this space, we also expect M&A activity to heat up.

- Most acquisitions were driven by a buy-and-build strategy, as Digital Health scale-ups seek to expand their offering by acquiring proprietary tech and new client segments. Examples include Boston-based Biofourmis’ decision to complement its analytics platform by acquiring swiss wearable company Biovotion; and Swedish KRY’s acquisition of mental health chatbot tech built by Shim in Stockholm.

Mixed industries: media, pharma, providers

- This miscellaneous group includes biopharma giant Roche and its acquisition of Mysugr, as well as the healthcare-focused mutual fund (Mutuelle Nationale Hospitaliere), an international hospital group (Schoen Clinic) and an insurance company (Groupe VYV).

- Acquisition motives differed in this category, but followed a similar buy-and-build pattern. The Mysugr acquisition fits a general trend in pharma to move “beyond the pill”. The fact that it remains one of the only exits in this space shows how difficult pharma is finding it to execute this strategy, and how difficult startups may find this exit channel.

- In the US, too, the second largest category of Digital Health acquirers are “miscellaneous companies.”

Healthcare distributors have also enriched their product offerings through M&A. One recent example is pharmacy group Zur Rose’s acquisition of Teleclinic, which makes sense given that 50% of consultations performed on Teleclinic’s platform result in electronic prescriptions.

In theory, medical device companies are natural acquirers for Digital Health startups. In practice, this type of deal is rare in Europe and the US. In one of only two M&A deals in Europe, Medtronic, the largest medical device supplier in the world, acquired Touch Surgery, complementing a large portfolio of surgically implantable medical devices with a high-tech surgical training provider.

Related Reading: Top Early-Stage European Healthtech VC Funds

The Digital Health party is just getting started!

It’s an exciting time for Digital Health startups in Europe. As we argued in our deep dive on Digital Health in Europe, it’s a nascent but fast growing sector. From an investor perspective, the ecosystem still lacks healthy and repeatable exit routes that can help drive VC returns. This is changing quickly, but from a very low level. As more European Digital Health companies reach scale and build a stronger M&A appetite of their own (think of recent funding rounds by KRY, Doctolib, Babylon), we think the flywheel is just about to begin to get going.