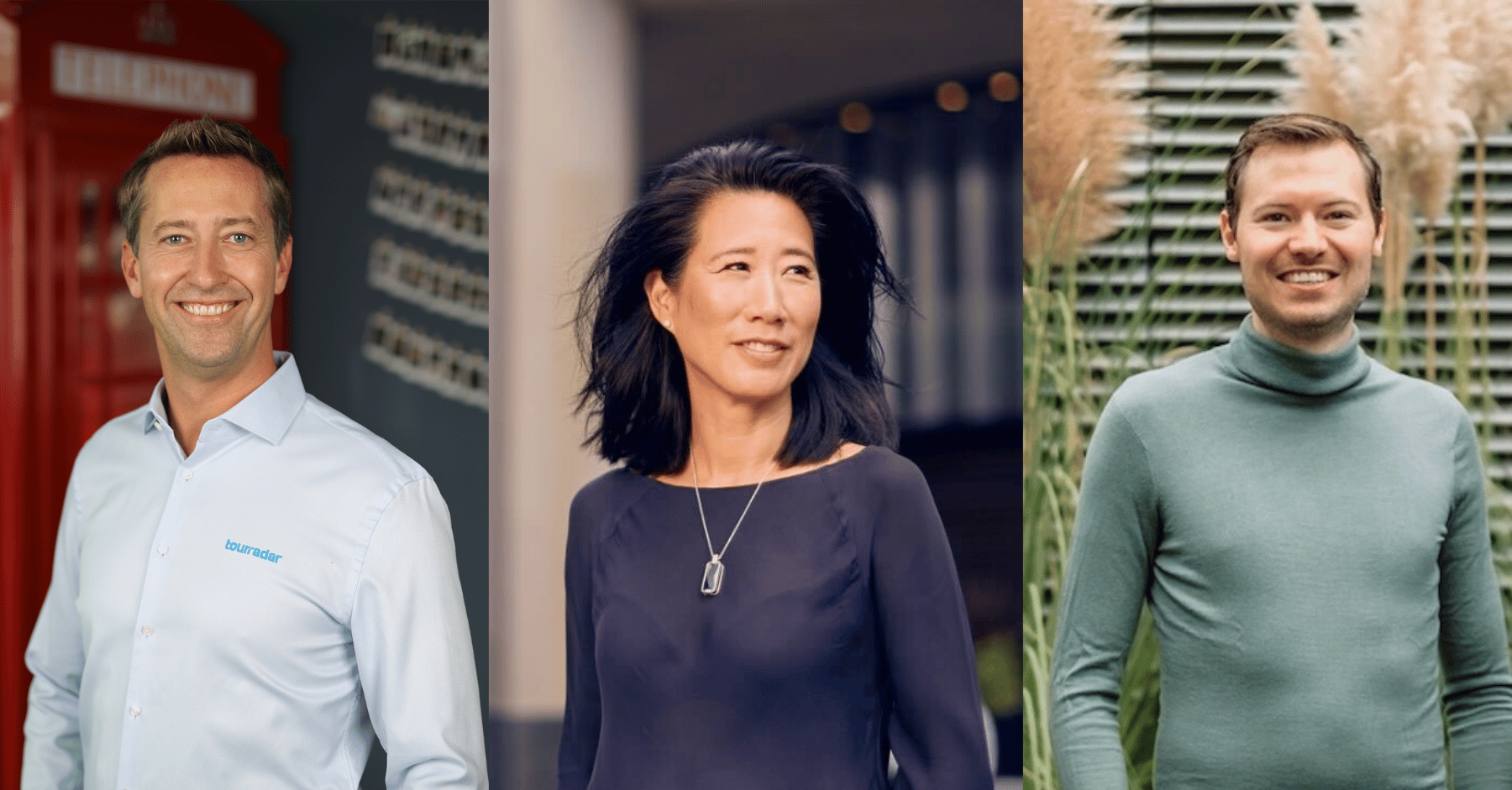

Joerg Floeck Joins Speedinvest as Managing Partner

In February, we announced a new chapter for Speedinvest with the €190m close of our third institutional fund. We have come a long way since being founded in 2011, but our mission remains the same — be the go-to, early-stage partner for Europe’s most visionary tech founders and startups.

With more than €400m in capital now available to do just that, it became clear that we, as a growing organization, needed to strengthen our management team. Thankfully, we didn’t have to look very far. I’m excited to announce that Joerg Floeck, our Executive Chairman for the past 18 months, is joining as Managing Partner.

Adding world-class management expertise to our team

Since joining Speedinvest, Joerg has been working side-by-side with our general partner team, building a clear understanding of the strengths, challenges and opportunities we face as an organization. He quickly became an invaluable member of the family, and further utilizing his knowledge and experience to strengthen our leadership team was only the next logical step.

How often do you have someone sitting next to you who has spent the majority of his career running a global company with thousands of employees across the world?

Joerg did just that at Thomson Reuters Markets, the world’s leading provider of intelligent business information. As an Executive Committee member and Co-Chair of the Global Operating Committee, Joerg was responsible for Thomson Reuters’ global financial services business. He has also served as a Member of the Strategic Board of CEMS, the International Business Advisory Council for Rome (IBAC) and the World Economic Forum in Davos. Not to mention, he’s an active business angel and corporate, non-executive board director.

While his enviable credentials may have opened the door to Speedinvest, the reputation he built as a hands-on, respected and trusted colleague on whom our entire organization can rely sealed the deal.

What does this mean for me?

As we now have Joerg leading our organization, and together with our COO Marie Muhr, overseeing daily operations, I expect to have much more time to focus on our portfolio, oversee our investment strategy and, finally, lead my own deals again — my true passion for the past 9 years, since I stumbled into the world of venture capital.

By playing to our collective strengths, we are making the changes necessary to ensure our mission to become the go-to, early-stage partner for tech founders and startups in Europe is successfully realized. It’s an exciting time filled with exciting opportunities, and we are thrilled to welcome Joerg along for the ride.

Speedinvest is a leading pan-European, early-stage venture capital firm. Our portfolio includes Wefox, Bitpanda, TIER Mobility, GoStudent, Curve, CoachHub, Schüttflix, TourRadar, Adverity, and Twaice. Sign up for our newsletters to get our exclusive content delivered straight to your inbox.

.png)

.svg)