We’re one of Europe’s most active pre-seed and seed investors in Digital Health. Check out our Digital Health Exits Q1 2021 Update and our overviews of the digital health ecosystems in France, DACH, CEE, Benelux and Southern Europe.

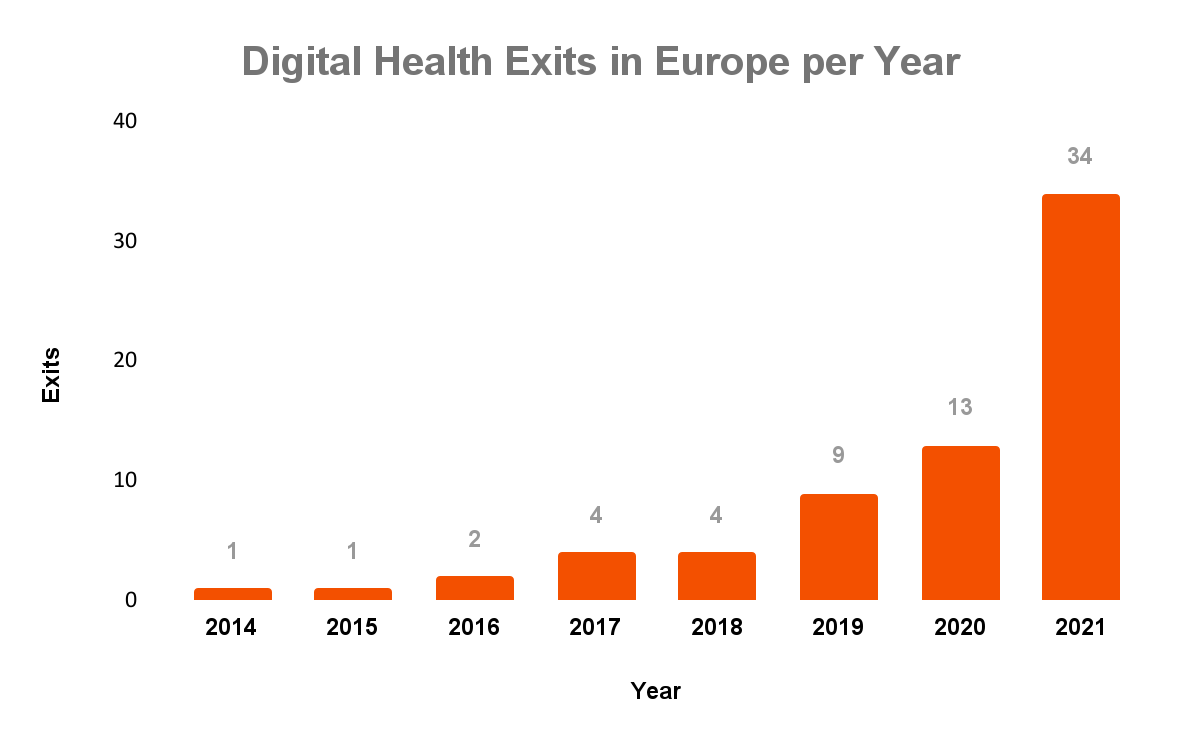

Digital health is still a nascent sector in Europe, but it’s growing faster than ever. When we last updated our overview of digital health exits in Europe at the end of Q1 2021, we counted 37 exits since 2010. Now that number is up 84%, totaling 68 exits. This perfectly sums up why we’re bullish on health and why we expect a lot more activity in the near future.

Even if only 1% of startups ever exit, exits are key moments in the entire ecosystem from investors to founders. Serial founders or key employers from the first wave of digital health companies return to found new startups and the cycle continues.

Our key findings for this updated report on digital health exit activity in Europe are:

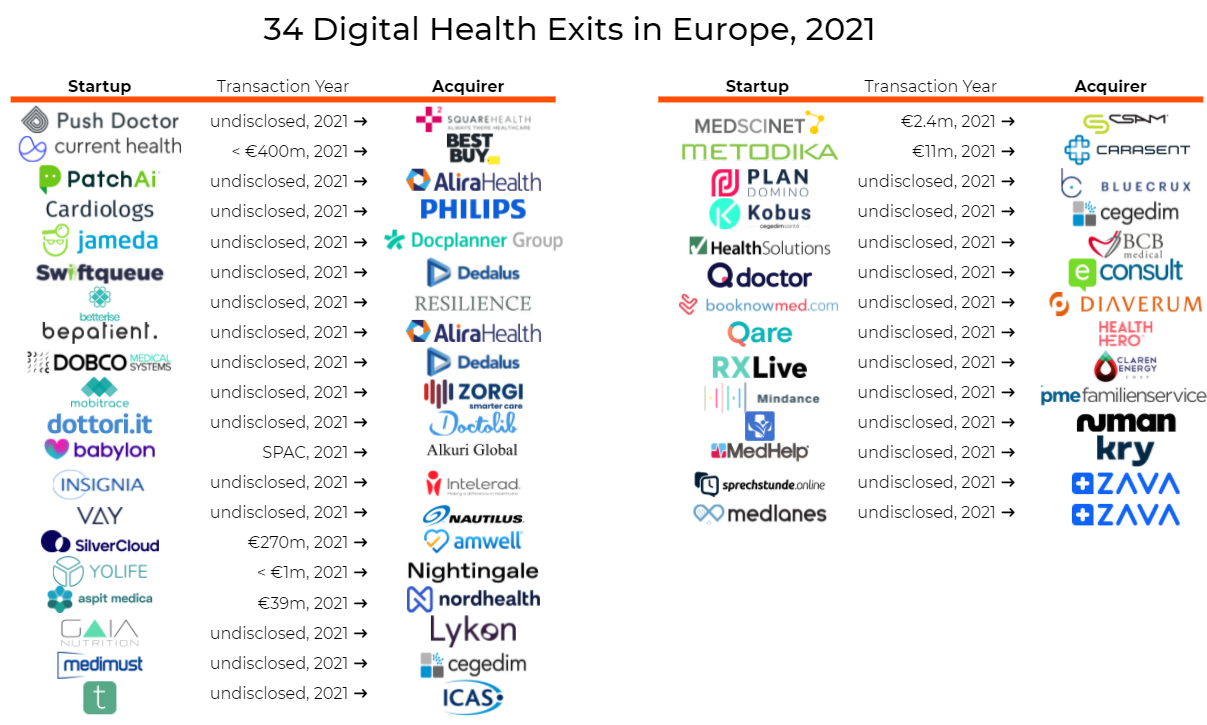

- Over the past decade there have been 68 digital health exits in Europe, with half of them happening only in 2021

- Babylon went public via merging with a Special Purpose Acquisition Company (SPAC) in a deal worth $4.2 billion, making it the first European digital health company to list on public markets - huge congratulations to the team!

- The pandemic accelerated overall adoption of digital health products and activity in this space, with an almost 3x increase in the number of exits from 2020 (13 exits) to 2021 (34 exits)

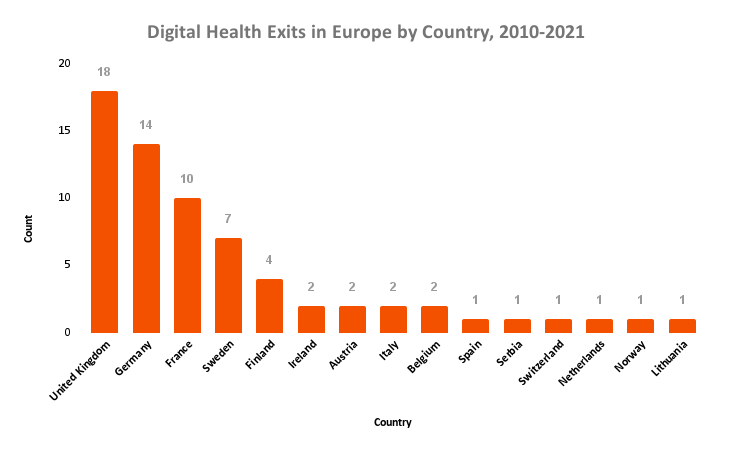

- United Kingdom leads with 18 exited startups ahead of Germany with 14

Here’s a visualization of the 34 exits that happened in 2021:

When we look at a year-by-year count, the growth is even more clear. There were over twice as many exits in 2021 as in 2020.

One noteworthy observation from our last analysis still applies: More than 131 digital health exits happened in the US in the first half of 2021 alone. This is almost four times the total number of European exits for the whole year.

The rest of the observations needed an update:

- Even with Babylon’s SPAC, going public is the least probable exit option for European digital health startups and M&As remain dominant

- Time to exit is increasing and we are starting to see larger deals happening in Europe (more below)

Where in Europe do exited Digital Health companies come from?

In our previous reports, we discovered that, although the UK is #1 in overall company formation and investment in digital health, Germany was leading Europe in exits. But with the updated 2021 data, we can see that the UK is now leading with 18 exits while Germany is second with 14 exits.

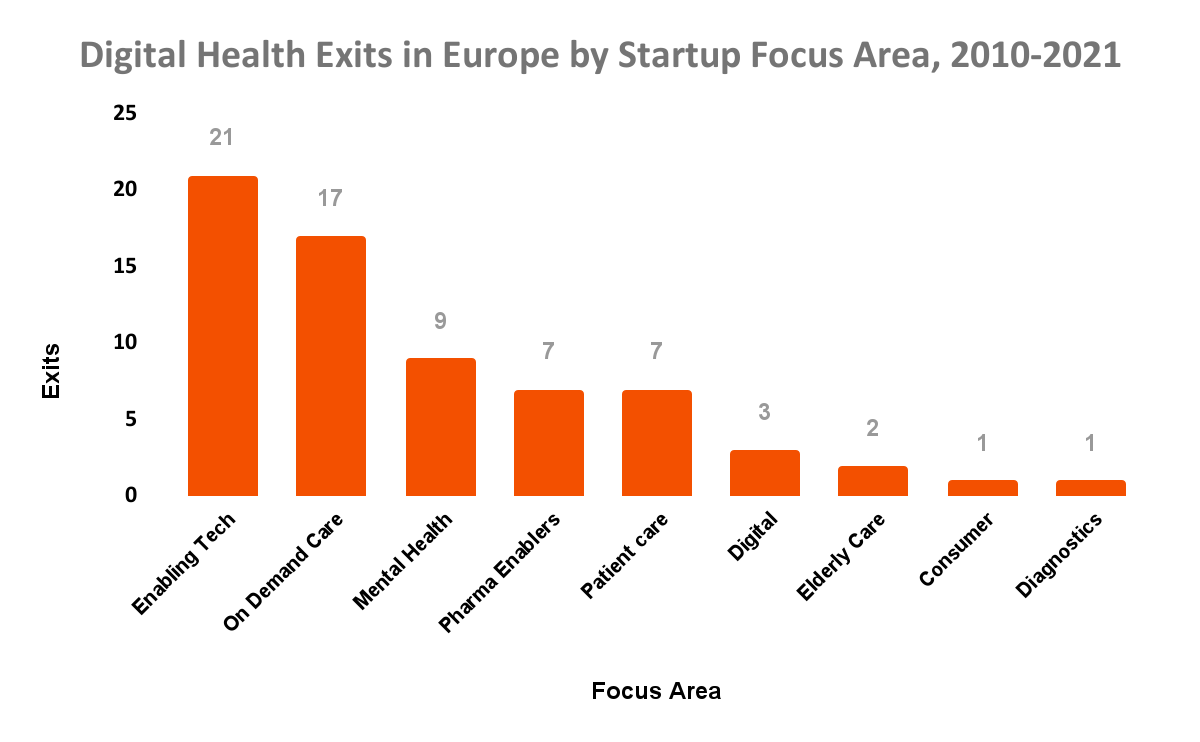

Exit targets: enabling tech, telemedicine and mental health

As in our last article, the updated data shows that enabling tech, on-demand telemedicine and mental health are still the most popular exit targets.

In line with the accelerated adoption of digital health solutions, enabling tech is the #1 category with 21 exits. The most popular acquisition targets are SaaS tools for healthcare providers that facilitate their job and make health delivery more efficient and effective: Mobitrace is developing mobile solutions for hospitals, Kobus enables physiotherapists to carry out all patient follow-ups and Aspit is a leading supplier of electronic patient record systems (EHR).

Time to exit

The average time to exit is 8 years, while the median time to exit is 6 years. This is a slight increase compared to our prior analysis, which got us to a median time of 5 years.

This is still slightly faster relative to other startups, but it shows that the market is beginning to mature - founders are starting to see more success stories coming out of Europe and long-term growth opportunities.

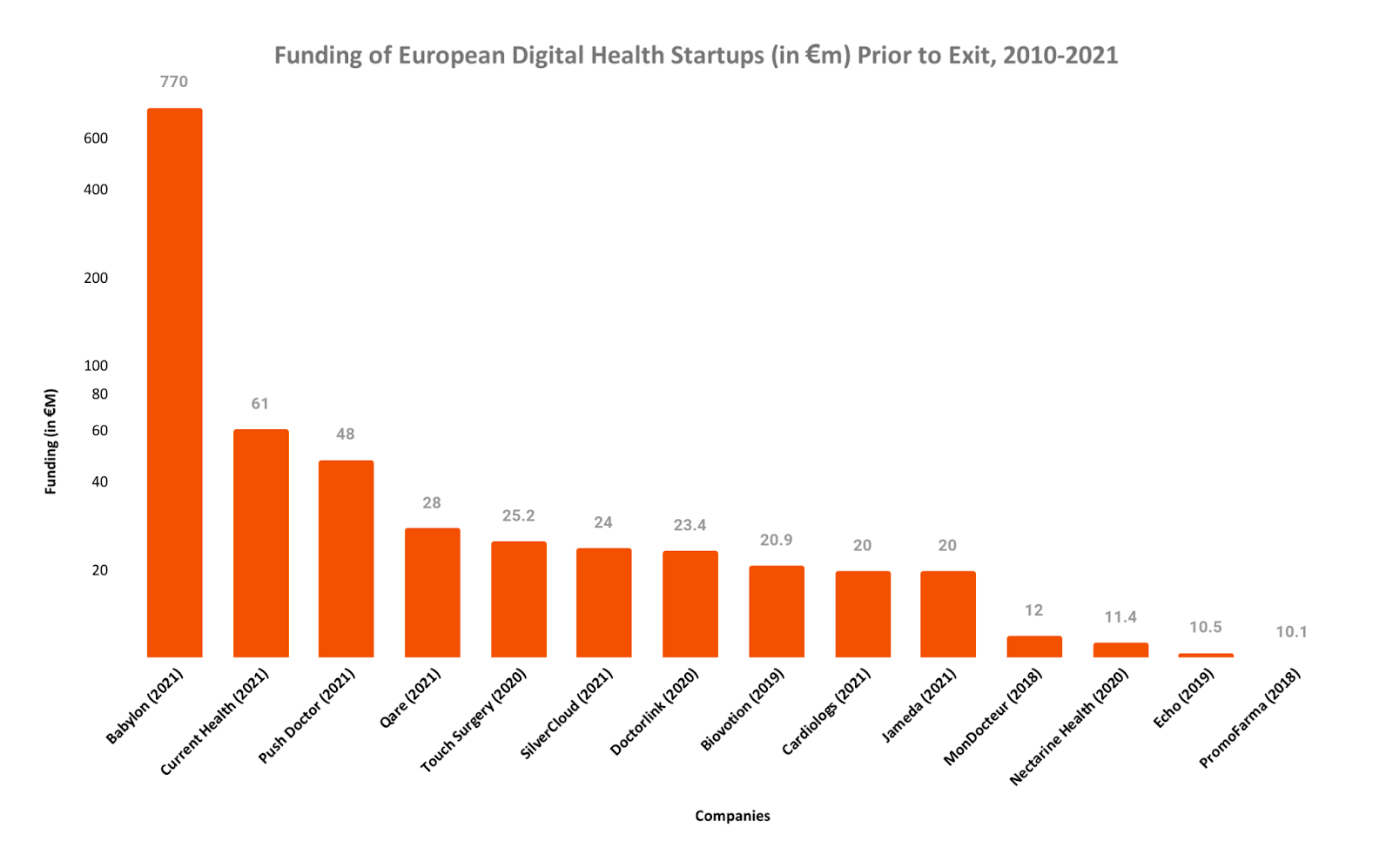

Funding until exit: low, but growing

Even if European digital health companies still raise fairly small amounts of money before they exit, we are seeing a rapid acceleration from our last update:

- We now count 10 companies that raised more than €20m prior to exit (that’s almost 3x the number from Q1 2021) and 14 companies that raised more than €10m (2x the number of Q1 2021)

- Average funding before exit hit €27m, a 4x uptick since our last update, driven mainly by the mega-round raised by Babylon and well capitalized companies like Current Health and Push Doctor.

Related Reading: Top Early-Stage European Healthtech VC Funds

Who is buying Digital Health startups?

Let’s use Rock Health’s H1 Digital Health exits analysis as a benchmark of what’s happening in the US.

We can see that the data is consistent with our previous findings. Both in the US and Europe, digital health companies are the biggest acquirers of digital health companies, accounting for over 50% of exits, followed by pharma distributors and a mix of other strategic players:

And here’s an overview of which companies have been buying:

This pattern mirrors a trend of bundling platforms and offering a single point of care service to customers. As more companies mature in this space, we also expect M&A activity to heat up.

Digital health scale-ups are seeking to quickly expand their offerings by acquiring proprietary tech and new client segments. Examples include:

- Polish booking platform, DocPlanner, acquired Jameda to enter the German market

- French appointment scheduling software, Doctolib, acquired Dottori, one of the main players in Italy

- Digital health infrastructure provider, Square Health, expanded its offering by acquiring virtual GP provider, Push Doctor

- Telehealth, Amwell, acquired SilverCloud Health to accelerate its mental health efforts

- Philips acquisition of Cardiologs to expand its cardiac diagnostics and monitoring portfolio

Similar to the US exit market, the second largest category is a broad mix of commercial players:

- BestBuy’s acquisition of remote patient monitoring platform, Current Health, is one of the largest exits in Europe

- Renal care clinic, Diaverum, acquired booking engine, booknowmed.com

It’s an exciting time for European Digital Health!

In our Q1 2021 update, we argued that healthy and repeatable exit routes are only just emerging and will help drive founder rewards and investor returns. That became even more clear in the last three quarters and the flywheel is only just beginning to turn - we expect many more acquisitions from companies that have now reached scale, such as Babylon, Kry, Doctolib.